Confidence

…The Missing Catalyst

These days, stock market prognosticators seem more than willing to mention a list of the items in their baskets which they consider to be market-moving catalysts. None the less, there seems to be one item which is gone …missing from amongst both their basket’s items as well as from their focus.

I believe that there is a rather sad and dubious reason for this though.

More on this one item later.

For now, of the many items which are in the prognosticators’ bags …some are those which appear in their rear view mirror, while …others lie up ahead …in clear view.

In spite of these items which are in clear view, the more important single most important catalysts remains pretty much hidden and out of view …intentionally swept under the rug.

On the bright spot …and looking backward in the rearview mirror:

Japan’s recovery is an indicator of their ability to pull together and whether a huge disaster in spite of the required sacrifices …much of which remain untold stories begging to be unfolded and told …in for no other reason than to serve as a testimony to the strength of human will and character …the Japanese cultural heritage of honor and service not withstanding.

Another item in the bag includes a mention which points to China’s preparation it has made to make a soft landing …a tribute to their foresight’s thoughfulness.

Closer to home, and in spite of political brinkmanship played out amidst an atmosphere of extreme rancor, the U.S. narrowly avoided a default on its debt …which testifies of one thing which is for sure; with respect to Japan or China …we are not that becoming …not all that and a bag of chips.

Resting on our laurels, some can reach in their bag of catalysts and claim that the U.S. weathered an S&P downgrade …however I would be remiss if I did not mention that many summarily (true to their knee-jerk nature) reacted shamelessly by blaming the entire fiasco on The Tea Party, excessively high sun spot activity …and the dawning of The Age of Aquarius …as well as your New Age postal person: WORD!

In the mean time, in spite of last Thursday’s 610 point plunge which followed the EU’s ECB’s bank-rate cut and subsequent announcement of it pursuit of a program to purchase member debt; U.S markets seemed to be poised for a rebound in spite of the ECB’s program whose model much resembled QE-1 & 2.

Remember that what weakens the Euro …strengthens the dollar. That all took equity markets by surprise that Thursday …going into that weekend.

Then on Tuesday, Ben Bernanke announced he would be keeping the Fed Funds rate steady throughout 2013 …and markets responded by rallying out of an oversold condition …into what may amount to be little more than a sucker punch …as the catalysts which lie ahead are no less uncertain than what the markets have already endured.

All together, as bad as the recent past two weeks have been on the markets, one could only hope that these last days’ exclamation marks were the last marks of pessimism to close out a Greek tragedy’s final act.

Unfortunately, that’s probably not the way this play will end ,,,for there is the sequel which must be played out next week …especially as we approach Jackson Hole next Friday.

The best news of the good news is T.G.I.F. and it is all …water under the bridge.

So, what is up ahead and around the bend? More uncertainty? More pessimism?

Is down the new way UP?

Well then, put on a happy face …that is …if you have the tools though.

The on-going European debt resolution which entails discussions of various mechanisms which may allow the ECU to monetize its E.U. members’ debt in a timely fashion is definitely one of the biggest items which has preoccupied the news today …especially now that the rest of the free world has seen the affect of the ECB’s announcements last Wednesday …a central bank rate cut which helped the market make for a + 600 point sell-off.

As the Kansas City Fed’s Jackson Hole economic summit draws near, there are more suggestions being made that speculate that Ben Benanke may make an announcement which involves embarking headlong down a path in QE-3. Others say that he will merely sumarize and assert what known monetary policy he has already made public …as an attempted reiteration of a notion of confidence …in spite of the obvious lack thereof in the market place.

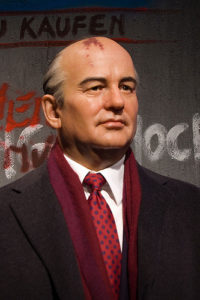

I’m guessing that a lot of next week’s catalysts hang on the European indicators whic most ikely may come from the EU principal negotiators, namely from Angela Merkel and Nicolas Sarkozy.

http://www.presseurop.eu/en/content/article/872281-markets-deaf-sarkozy-merkel-entreaties

If Europe trumps Bernanke …QE-3 may become a greater liklihood. If, that is the case (God Forbid) watch for clarity from Bernanke …or lack there of; for how the markets may move …should depend upon Bernanke’s clarity of direction …regardless of how the European negotiations proceed …which till now have been moving at a snail’s pace.

The coordination of the release from both continents will make for an interesting opportunity to observe distinctly separate …yet the mutually beneficial interests of a global banking community …one where stability makes for better markets …more so than currency wars. The bottom line; the outcome of both sets of meetings will constructively impact how each continent will manage its debt for years to come.

At any rate, the Jackson Hole meeting is slated for next Friday …which has comparitive timing written all over it.

What time of day any announcement or address is made will sure be highly anticipated, especially if it were to be made ahead of the close of the trading day.

Regardless, watch this for any impact it is sure to have upon the stock and bond markets.

Regardless, of all the things which are considered to be catalysts ….where are the passionate mentions of the leadership’s solutions which would …could …and should …above all else …address the abysmal housing inventory and jobs markets?

In this regards, housing solutions sure have been scarce these days! No wonder why this is so-called recovery is referred to as “…Job-less.”

Come to think of it, whether it be a solutionless recovery; they (both housing and jobs) have been (non-recoveries) pretty well non-existent the last three years …void of hope and change …or, what?

If housing is a non-participant, who is fooling who around here?

Let’s see; logically stated …Full economic recovery is one in which housing and jobs participate to contribute to a healthy consumer driven recovery.

No housing equals …no jobs; and no jobs makes recovery difficult …if not altogether impossible.

So, why would anything which is considered to be so pivotal and central qualify as a catalyst which has somehow become the red herring …or the red-headed step child?

How has housing become so overlooked so as to becom all but missing from much of the core of the national conversation?

Yet for as scarce and missing as housing has been from the national conversation …is it not the single most important CATALYST IN THE BAG???

Well, then …has housing become so scarcely mentioned?

And in regard to solutions which pinpoints housing …hos is it that they have been totally missing from the national conversation?

Could it be that the administration’s agenda is so hell bent on making the banks and the rest of the entire financial industry its whipping child …that it has all but tied up opportunity and thrown it in a jail cell in Dodge City?

Sadly, equally scarce and missing are the passions and fascinations gone and void in the pursuit of solutions which could and should serve to bring back opportunity …for such as those who qualify, for those who desrve …and above all for those who desire to become home owners.

Here is an opportunity to mention the importance that desire must play in any perception of what makes an opportunity appear so attractive.

The factor of Desire is like a narrow spread bewtween the purchaser’s bid and the seller’s ask price.

Desire on both sides of the fence …is what brings the two together …to reach an agreement.

None the less, housing and housing solutions don’t seem to be a desired component of recovery …and there is no political reasonable room for this in Washington any more.

It is time to straighten up and fly straight …straight and direct as an arrow to reach a highly desirable housing solution …the sooner the better.

Is it any wonder why exasperation has been rising in the wake of such which has gone missing for so long?

Having no housing solution may be perceived as Ben Bernanke’s biggest short comming, but it becomes even more so disparaging in view of the dynamics of the national conversations of the recent past …those political pursuits which are those which enjoyed measurably much more passion, vim and vigor in the administration’s frivolous pursuits of the likes of Cap and Trade …Financial …and health care reforms which were hard pressed priorities …moved forward with a super majority that the Democrats enjoyed for quite a lengthy period …while housing and what would have …could have and what should have made …instead for jobs …lay helplessly (no thanks to the Dems Super Duper Majority) on the back burner …as if dead …only to be ignored …as line unto a has-been, cohesive national energy policy or coherrent budget …were not more pressing basic priorities.

But then again …pretzel logic is like this …exasperating!!!

Hence, the rise of the Tea Party; and cooler minds prevailed last November.

What else has enjoyed less air play than the purpose and pursuit of a housing solution?

NOTHING!!! WHAT’S THAT ALL ABOUT!!??

THAT ALONE IS THE 800 pound Catalyst in the room!

Consider Dodd-Frank’s purpose for all the damage it has managed to do. It received considerately more air play than any discussions related to how to resolve and solve the existing housing inventory.

Are the solutions which would solve housing, jobs and unemployment be too big to succeed? Or are they just too small to bother?

If America can not afford to avoid to address too big to fail; why is America failing to address these two eight hundred pound gorillas in the room?

Since when did it become chic in America to ignore the reality of priority?

Oh, I forgot; being a liberal entitles one to see the truth from a more limited personal perspctive …regardless of reality.

Seems to me that the more we focus upon our side-show ancillary other catalysts …the less we have been keeping our eyes on the ball.

If there is no respect given to priority; there is a likelihood that the same willy-nilly respect has touched one’s perspective of order.

Swing batter! …Batter …batter …batter! Strike three! Yerrrrr….out of there! Next! Batter-Up!

In all of these so-called lesser …side-show catalysts mentioned above, the real deal (housing) should be taken with equal …if not greater concern …so as to be made the greatest object of our focus …rather than all that which has all but served to sweep the real solutions under the rug …as if the two 800 gorillas it could be made to disappear …like a David Copperfield 747.

Unlike vanity, majic is the realityof an illusion; while vanityis merely the illusion of reality.

Just because the housing and unemployment issues can be made to appear as obscured and overshadowed by what it has been impacting …that does not justify ignoring the illusion in which the imagination has been decieved.

While ignorance is not incurable; remaining so is. It is the result of chosing to be dumb in spite of knowing better …even after having chosen to escape ignorance. Painfully dumb is circular thought.

This is why even Jesus Christ said with certainty; “…you will always have the poor …â€

This not callous. It is just the way it is. Poor stewardship is what got us into this mess in the first place. It was not ignorance.

Ignoring the fact will serve to make certain one stays so as long they choose.

Welcome to The Hotel California. You can check in anytime you like; but you may never leave.

What Jesus was saying in this is that poverty is a choice of the heart.

If choice ..or the availability of choice is unknown miraculous treatments may be available, completely out of reach …because of one’s ignorance.

This is no shame, but it is also no reason not to seek a better solution.

Likewise, instead of continuing to merely treat the symptoms, is it not time for America’s leadership to set its sights on treating the patient?

There are catalysts …and then there are catalysts.

And Inspite of all the sideshow catalysts …there are roots and solutions which can get to the root of the problems to offer a more expeditious cure …once and for all …as needed.

I would say that America has forgotten the root cause …only to become preoccupied and busy with treating and reacting to all the ancilary catalysts …the symptomatic affects caused by the impact of the disease …which like a cancer has been eating the patient up one side and down the other.

Without dealing with the root, American leadership has chosen a path more than misleading …in that deliberate ignorance is …and has been more than an out right bold faced lie. It is just plain the heighth of chosing to be dumb.

To this, I say …almost three years ago, leadership choose to sidestep its primary responsibility to execute according to the logical protocol of economic triage …namely by choosing to pursue an order according to the most urgent priorities.

Today this ignorance remains …principally by reason of politically driven greed …party above people.

Today this failure of oversight persists in and with a mindset which is blind to the root cause of its greatest grief’s woes.

Chiefly America’s leadership must no longer be allowed to continue to blindly ignore the pursuit of an effectual means by which to address the problems of housing and jobs in America.

To fail further in this regard is akin to dumb and dumber.

Regan would have spent money on training. Obama’s approach has been and still is what amounts to little more than unearned hand outs.

America doesn’t need nor want politically motivated quid pro pro hand outs; America wants a strong hand that is also more than capable to offer a sure lift up and out of a rut which government created in the first place …primarily in its failure to provide adequate oversight.

America can no longer afford to ignorantly sidestep and avoid the solutions which have failed to choose to make housing and employment matters of the utmost …highest priority.

After almost three years …isn’t it time to get our priorities straigth?

These two issues are too big to fail to recognize that we have already failed in our dismissal dismal, marginal treatments of them.

Therefore, now …is the time. For there is no better time than the present to deal with their reconciliation.

America must be prepare to admit failure. Ignorance can be reconciled in and by an order of knowledge.

Now is the time within knowledge to be resolved to redeem the time of the day while it is still day.

If we fail to seize the day, what then?

Otherwise, in ignorance …America may likely get the opportunity to call the fear which grips the dumb …a double dip recession.

Fear is the manifestation of a lack of action …by reason of a lack of knowledge, understanding and or wisdom.

America has to get it …and get it all together in order to avoid becoming eaten up by the affects and impact of fear. God forbid it should come as a result of a lack of leadership.

And what is the root of foundation of fear?

I would say it is a lack of confidence …by reason of a lack of affectual experience …gotten by reason of knowledge …understanding and wisdom.

To this I would say; it is time to nip this lack of confidence in the bud with an abundance of what builds confidence and trust …two scarce commodities which could …would …and should work if America were to ever get its collective mind joined together to make an agreement to earnestly work on making opportunity available in oreder to expand housing and jobs markets.

In availability …opportunity offers choice. Without availability, there is no opportunity and there is no choice.

In view of what we have failed to do so far, now …it is the time to be getting busy looking for something which will effectually work to produce an abundance of the availability of what all ot that which makes for opportunity. Build opportunity and confidence and trust will follow.

In terms of who or what is the party of no; I believe that it is time to stop all the finger pointing and take a long look at ourselves in order to make for better opportunities and better choices …hopefully with an eye on priority.

Without these two …housing and jobs …there ain’t no use in even thinking about hope.

Until then …and to this end, I leave you with the following idea.

Check it out in greater details at the link below.

Until then …Do Not Pass GO; Do Not Collect $200.

https://www.geoblography.com/?p=1110

Field of Dreams – Build It and They Will Come

So, why wait for another minute to pass go?

Why need to wait for another catalyst?

P.S.:

More and more, I have been hearing comments about how many companies’

stocks are undervalued …given their p/e multiples.

Invariably, when this occurs …it gives me the opportunity to point out the fact that much of this apparent irrational disconnect can be attributable to uncertainty in the market place.

And much of this is justifiably so as such may merely be a reflection of the overall disatisfaction and the lack of confidence which iminates from the uncertainty steming from our over-arching lack of confidence in our national and global institutions.

Fear is a dark deeply irrational component of the emotional aspect of the human nature and psyche …one whose extension does not stop with the individual. It is a spirit which knows no boundaries nor limits …save that it is subject to the light of its polar opposite, confidence …both of which dominate …competing to challenge the balance of all things …moving markets back and forth and either in or out of order …with or without decency.

Therefore, let your light shine and let your representatives in Washington know that you would like to see a two year housing solution executed.

Built it and they will come.

Just do it.

What do you have to lose …a lost decade, or what?