Community Organizers

vs.

Agitators

and

Other Reptiles

It seems like every time I look up, there are more empty homes in my neighborhood.

Goodness, how can that be?

I guess that, if mine is representative of most other neighborhoods in my community …I could safely assume that there are fewer homeowners to shoulder my community’s costs which must …for goodness sakes …be levied on those remaining homeowners …those who haven’t thrown in the towel and or turned in the keys …yet.

Add to this, that there are more than just and reliable expectations that real estate prices may drop still further …and you have the makings for a perfect storm …a continued march toward realizing the realities of The Great Depression, yes?

Goodness Toto!

And, for this reason, it is easy to see why single family dwelling housing has yet to rebound. Rentals may be hot and up, but …today, more than ever it remains questionable as to whether or not the patient will recover.

As such, there remains an appalling, growing …lack of confidence in the doctor’s care of all things economic. …who for all his neglect …there has not much been affordably offered organically which lends credence to build confidence that the body politic even cares much for treating the patient who may not get up off the government’s operating table.

Now what kind of bedside manners is that? And what sort of consideration is that?

This treatment doesn’t even qualify as being two-faced …let alone, care.

You might say, in view that inflated appraisals are still dependent upon artificial means …the patient is still to weak to walk …in an atmosphere of self-serving interest …where the debt and its debt-load’s payments have more than trumped the interests served by our forefathers whose purpose it was to form a more perfect union …one indivisable …of the people …by the people and for the people ….rather more than merely …one for the furtherance dolar denominated commodities …through the public debt and our ability to serve it by merely exhasting every means at our disposal necessary just to manage to artificially service the maximum allowable debt load …in neglect of the princapals of oversight, accountability and transparancy.

But for all that, communities are still walking all over what (tax-paying) homeowners remain on the government’s operating tables …and are still in their houses …either paying or not paying their mortgages.

Thankfully responsible local and county officials have and or are now finding ways to execute fiscal responsibility …or, at least a body would hope to think that …that would be the worst case.

However, in the wake of more than two years of Federal hand outs …states have had the luxury to neither do anything new …nor, the need to take any creative affirmative action.

So, just when you thought it would be safe to go back into the water ….ask yourself; how bad could worse become?

Sadly, the best affirmative action …of the worst choice …has been to do nothing but remain calm while further gouging home owners with higher appraisals …while avoiding the pursuit of tougher more meaningful pro-growth choices.

Now, without having taken the opportunity to make sacrifices earlier …the consequences of failing to act sooner may require some rather objectionable hasty measures.

How homeowners may react to this sort of treatment may become what what might happen when a trapped animal’s instincts kick in when they are cornered …and have no way out.

Now, the national mind-set of “cut” will offer still less room for the luxury of a mind-set which should of …which could have …which ought to have been busy preparing pro-positive …far better means and measures whose priorities should have have taken and seized and made the best of every opporotunity to develop, build and promote pro-groth …efficiently …and organically.

And since a mind-set which otherwise would have been busy out wooing industry …looking for and chasing jobs to build local economies has been pretty much over looked.

Well, last November’s mid-tem set an about face president …whose resultant …rather limited (no-choice …last-minute option) must be to either cut spending and or to raise taxes …which further exacerbates the cut mind-set further.

Unfortunately the mindset which promotes pro-growth has been further suppressed …in favor or the post November mid-terms’ populist cut this and cut that mentality. So, what’s a body to do?

This lack of focus upon pro-growth …which is what has been pretty much what has been happening with or without respect to relying upon rising home owner’s appraisals as a primary source of increasing tax receipts in an atmosphere of declining economic activity …is at the heart of a two dimensional mind-set …debate which has all but left the ideas of growth and it priorities …completely out of the picture …the national conversation not withstanding.

So rather than grow revenue by organically growing local tax bases …either way which one may care to characterize the landscape of local and county fiscal accountability …the private property and homeowners are the ones who are still losing in the battle.

Well, with respect to the end of the Federal gravy train (much due in thanks to last November’s mid-term elections) …politicians on all levels have been served notice with orders which have caused most politician, public officials and bureaucrats to appear, at the very least …to be more proactively engaged in exercising more fiscal responsibility.

So, now that 2012 is nearing and the train is on its way toward the station again; can homeowners and tax paying Americans expect more accountability from their publicly elected officials?

Go figure how responsible voters have been in the recent past general and mid-term elections.

I, for one …would hope that America …in Her march to embrace fiscal sobriety …just might realize how much further there is to go in order to truly do so …rather than merely go through the steps without having a true change of heart.

Metaphorically or not, homeowners are not the only ones who have felt …and are continuing to feel the affects of fiscal irresponsibility on all levels …both coming and going into and out of all of the recent bubbles.

Among others, politicians have and are …and may feel the affects of debt now …more than ever …2012 not withstanding.

Kind of makes me feel for them all …not!!! Not at all!

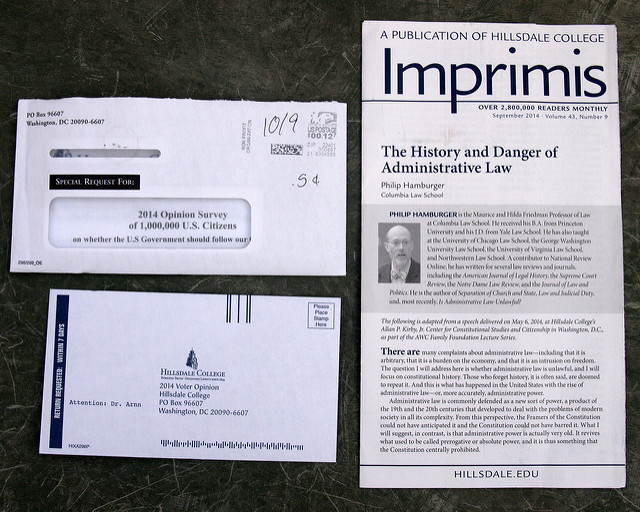

With this in mind, see the graphic diagram below for a reference to a unique aspect of a certain subject which needs to be made a permanent part of the national conversation …one within full view, clear and transparent view. of all.

Every American needs to totally understand and be totally aware of what this matter is …and what is at stake because of its insidious grip upon almost every aspect of what we as Americans hold near and dear …and what how it is that we have almost let go of and lost it all.

The Portion of the pie below called “Debt Load†(is the interest portion …or, debt service costs not shown) …and is = Approx. to 1/2 of the Depicted Deficit …& 1/4 of the Entire Pie …even …as the Budget Now Stands with such a large portion comprised largely of deficit (unfunded and or borrowed) spending.

http://www.investors.com/EditorialCartoons/Cartoon.aspx?id=567991

Note: Illustration from the link above is from Investors Business Daily and is a political cartoon by Ramirez

Now, consider how the organic remainder of the pie would and or will change …as these portions’ percentages change …that is to say; when & if …the deficit is …or can be reduced.

The more the deficit is cut …the more its deficit reduction will cut into (and further restrict) exacerbating the impact on whatever remainder of the pie is left over …in terms of obligatory …socially mandated …chartered spending.

Most importantly, understand …and keep in mind that the “Debt- Load†is a fixed cost.â€

It’s is not like you can just reduce it, unless principal debt is reduced first …yeah, right …and where is that going to come from now …in this world of hurt and artificially printed fluff?

So, reducing the deficit will not change the “Debt Load†…save for making it a larger percentage …or portion …of a smaller pie.

Note: the point is less …reducing the deficit …increases the size of the debt-load when taken as a percentage of the whole …I.E.: when taken as a percentage of what spending ability remains …when deficit spending is reduced.

Deficits …thanks to the administration and Congress have forced the hand of a Fed (almost out of amo and weaponry) to come to the table with an understandably accommodative weak-dollar monetary policy.

Thus, a more honest perspective of the relationship between the deficit and the debt load should help to make Americans realize that DEFICIT REDUCTIONS …seem almost like a pipe dream in the reality of this administration’s inclinations which lean more toward ushering in an era of socialism …rather more than a genuine prioritized interest in organic economic recovery.

Such as may have been temporarily been good at giving the Treasury Secretary a short-lived reprieve from the stress of the days of Paulson …in the heat of the crisis.

After all, with yields held artificially low since those days gone by, it is easy to understand why the Fed’s policy is called an “accommodative†policy.

However, this low yield policy accommodates no one more than Congress …in a fiscal sense.

The Congress would have a difficult time explaining away a higher debt load and a larger deficit …which would be the case …if yields on treasuries were to double …let alone rise 25 percent.

Yet, for all that argument’s sake; higher yields are inevitability. In this respect alone, the Fed (thus far) has bought Congress invaluable time …giving the Senate and the House a good deal of needed spending leeway …as the Treasury has been given the green-light to monetize the debt in an all …howbeit artificially â€LOW-Yield†temporary environment.

In lay terms …this is akin to breaking into our kids’ piggy banks and pushing the debt off of the â€Short-Handle†…out …somewhere into the future …I.E.; onto the â€LONG-HANDLE.â€

All smoke and mirrors aside …the costs of keeping the debt load small are set to change, and …as Bob Dylan once sang; “…you must serve somebody …â€

And the times …the times, they are a changing.

Can anyone say goodbye? Yes, say goodbye to QE-2.

And …if you can …the Fed may …and then the Treasury will …then, also be a saying; “…goodbye …and hello!â€

And together, our collective goodbyes and hellos will then come to form one big ole …meet-and-greet …to usher in higher yields and rates.

Accordingly, in low GDP growth environments …and, in this way, debt load will grow accordingly …albeit also in step with the deficit in a variety of ways:

1. When deficits are fueled by further borrowing which grows the public debt.

2. When a growing public debt results in higher finance costs called the “Debt Load†…which is a fixed portion of the annual budget …assuming; in an ideal world …that the deficit does not shrink to make this fixed portion of the budget appear as a larger percentage of the whole.â€

(NOTE: When deficits grow larger; this makes the “DEBT LOAD†appear smaller …by virtue that the “debt-load†… and then can be made to become a smaller percentage of the whole …as the whole becomes un-holy more reliant upon borrowed monies.)

3. When the deficits are cut …in low …no …or negative growth environments. This only makes the “DEBT LOAD†APPEAR LARGER …as a greater percentage of the total ( 100 % ) budget. In this case, cuts in the deficit absolutely impact the requirement to take cuts in other areas which can not help but affect constitutionally chartered, social obligatory mandates.

Yet, for all the unavoidable consequences of Congress and the historical administrative fiscal irresponsibility compounded throughout and over the years; nothing is more despicable than being hit by a sucking swoosh of taxes at a time which would threaten to pull down the fragile economy …back into another and deeper recession.

Yet, what form of a tax might pose such a threat?

I would say that the source of this tax is upon us all thanks to …a weak dollar …dollar denominated commodity called oil.

God help us all if oil prices were to decouple from the strength of the dollar …especially at a time when the Fed is just about out of bullets and weapons …and friends who will still bye Americans treasuries.

Yields are a form of bribery which says …without a ransom note; Please buy? 6% ….Please buy at 7%? …Please 8% …etc., etc, …etc. …like prices move on the third day of a garage sale gone terribly wrong.

None, the less …economies around the world are in a growth cycles which have DOUBLE DIGIT GROWTH written all over their respective currencies and monetary policies …leaving the U.S. as the lone …odd man out.

Why?

I’ll give you one guess …and it isn’t related to making housing more affordable …nor has a weak accommodative monetary policy have anything to do with …creating jobs.

It is about …one thing …floating the note …primarily affordable and manageable responsible fiscal policy …and executing on this pin point without becoming the one being executed …period.

To this end, I will say that …after the administration and the Senate have done all they could do to just about kill the banking industry’s ability to contribute robustly to the tax coffers …what else is there to fuel the federal government’s tax coffers?

Energy?

Well, this gives me the opportunity to return to tie this together with one central theme.

It is worth noting that …each time one fills up his or her vehicle …there is this sucking swoosh which vacuums dollars out of and away from every local economy. This translates to …fewer dollars for even the local banks to work with in order to multiply and grow the money supply organically.

What’s the bottom line? Is there any wonder why private real property appraisals continue to move counter to actual market realities?

The burden upon the private sector to support government is becoming more and more like that of communism …in which the primary purpose of the worker is to support the state.

Whatever happened to life liberty and the pursuit of happiness?

I rather think their demise is tied with irresponsible deficits …tied to fiscal and monetary policies.

My point is …deficit spending has …as its roots …(fiscal irresponsibility not withstanding) has been the driving root-cause of this sucking sound all along.

Put that in your pipes and suck on it a while Mr. Ron Paul …Mr. President …wanna be?

Federalizing …or nationalizing the banking system is not solving the problem …it is adding to it.

For that matter, if congress can’t run its own house; what good dammed reason is there which should cause me to believe that it can run a privatized banking system …which hasn’t been able to oversee and regulate with any growing degree of lessening certain absurdity?

To this end, and in the same manner, there is an equally absurd argument circulating in the halls of Congress regarding an over-arching national energy policy.

Seems as …in the absence of one …it may be easy to make it appear as if the government is engaged in its policies …choosing winners and losers.

And in this way, it may also be easy to argue against continuing to offer and extend any tax credits to any player by deeming this policy no longer popular to politically support …principally by extolling the the populist virtues which favor bashing large oil …much in the same way the administration bashed big banks for the larger part of the last three years.

In an environment in which the woes of fiscal responsibility may easily dictate arguments which favor the abolishment of such energy credits …oversight begs to differ …or, at least review why …what ans how these credits were, are and should and could be implemented in order to further America’s better national security interests regarding energy independence.

Policy in a flat world where the interests of the global economy should be a consideration which trumps …an insidious short-sighted policy which parades under a cute slogan which makes picking winners and …therefore losers …contrary to America’s better interests.

However, there may be a man or two behind a curtain with ulterior motives …and yes; there is no place like home …homeland security not withstanding.

Pay no attention to the man behind the curtain …indeed!!!?

Removing the tax credits on large oil is a smoke screen …one designed to keep bridge fuels marginalized …and temporarily on the sidelines.

As big oil knows, what will needs-must continue the weak-dollar (accommodative) monetary policies …there is nothing that a politically inept Congress will do to abate Washington’s dependencies upon deficits for the next ten (10) years.

All promises and good intentions aside, what do they say? “All the the best laid plans of mice and men …?” Or, was it; a bird in hand is worth two in the Bush …or five in Obama’s?

Even the Paul Ryan plan could use a few good Boy Scouts to aggressively improve upon his plan’s time line. Prickly is any “BET-ON-The-Come” political feel-good promise which never factors in preparedness. After all, who can stand in the way of Mother Nature and the occurance of all the o-so over looked actions which some look back upon only to characterize natural disasters as the result of being in the hands of an angry God.

All profits aside; what is the Boy Scout Motto? Be prepared.

Come! Come, now! How much wisdom can there be in that?

Meanwhile, oil companies will continue to be in an enviably luxurious position to play a wait and see game of patience …as Congress creates more of a sucking “SWOOSHING†noise …and the deficits play into the hands of patient big oil companies …speculators (along with hedge fund managers) not withstanding.

In time, what’s the big deal if the net affect of giving up a measly tax credit or two offers big oil the opportunity to reap a harvest …allowing them to play an even greater (dominant) role in developing bridge fuel technologies after a congress which is fiscally addicted to a Fed’s accommodative weak dollar (deficit- driven) fiscal irresponsibility.

As a politician, any one can survive …as long as such, one can maintain a chameleon-like populist stance.

But, in reality; a well known wise man once said;

“You may fool all the people some of the time, you can even fool some of the people all of the time, but you cannot fool all of the people all the time.â€

So, seriously; don’t be agitated, and for goodness sakes don’t be aggravated.

For …a house divided shall fall.

After all, there are and have been many …who, for years …it can be seen; have been pretty good at knowing how to peddle snake oil.

So, don’t be taken in unaware …by the very sensual and emotional nature of all their promises’ appeals and charms.

So, be sharp as a two edged sword, because you will need the truth to deal with whatever may be in each chameleons’ reptilian repertoire …populist non-sense not withstanding.

Care for some nice shinny ruby red apples, deary?

Don’t fall into a pit.

Become organized and plan to vote come 2012.

Above all, don’t confuse a community agitator with a community organizer.

Bottom line; don’t be fooled by a chameleon.

Chameleons crawl on their bellies like a snake …or any other reptile.

And while they pretend to speak for all …they speak for no one but themselves.

O Joshua!

All the best,

Bill